Business valuation is one of the most complex and high-stakes activities in finance. From private equity firms sourcing their next acquisition, to M&A advisors preparing fairness opinions, to corporate finance teams benchmarking performance, accurate and timely valuation data is critical. Yet, most professionals still rely on outdated, fragmented platforms that are expensive, cumbersome, and slow.

is changing that.

ValueEQ is an AI-powered valuation platform built for finance professionals who need instant access to institutional-grade data and tools without the inefficiency of legacy solutions. With 60,000+ public company comps, 60,000+ M&A deals parsed daily, and an end-to-end suite of valuation tools (WACC, DCF, multiples, and more), ValueEQ empowers analysts, consultants, and investors to deliver insights with speed, accuracy, and defensibility.

The Problem with Traditional Platforms

• Outdated Data: Legacy tools often rely on quarterly updates or delayed reporting, leading to stale comparables.

• High Costs: Platforms like Capital IQ or PitchBook lock users into inflexible contracts costing tens of thousands annually.

• Fragmented Workflows: Analysts juggle multiple tools (Excel add-ins, databases, and manual data cleaning) just to produce a defensible valuation.

• Slow Turnarounds: In deal-making, time is money — but traditional methods force analysts to spend hours gathering and validating comps.

Result: Finance teams lose time, increase error risks, and pay too much for tools that don’t keep pace with today’s speed of business.

ValueEQ’s Solution

ValueEQ is designed as the modern alternative: one integrated workspace where all valuation tasks can be completed seamlessly. It combines global datasets, AI-driven parsing, and analyst-friendly workflows to ensure results are faster, cleaner, and compliant with International Valuation Standards (IVS).

Key Differentiators:

• AI-Powered Insights – Natural language queries (“Find SaaS acquisitions in Europe under €200m”) return clean comp sets in seconds.

• Global Coverage – 120+ countries, 70+ exchanges, and tens of thousands of private & public comps.

• Real-Time Deal Flow – M&A transactions parsed within hours of filing, with multiples extracted and normalized.

• Valuation Workflows – WACC calculators, DCF engines, DLOM models, and report generators in one place.

• Flexible Pricing – Solo plans at €99/mo and team plans at €240/mo — up to 90% cheaper than legacy competitors.

Core Features in Depth

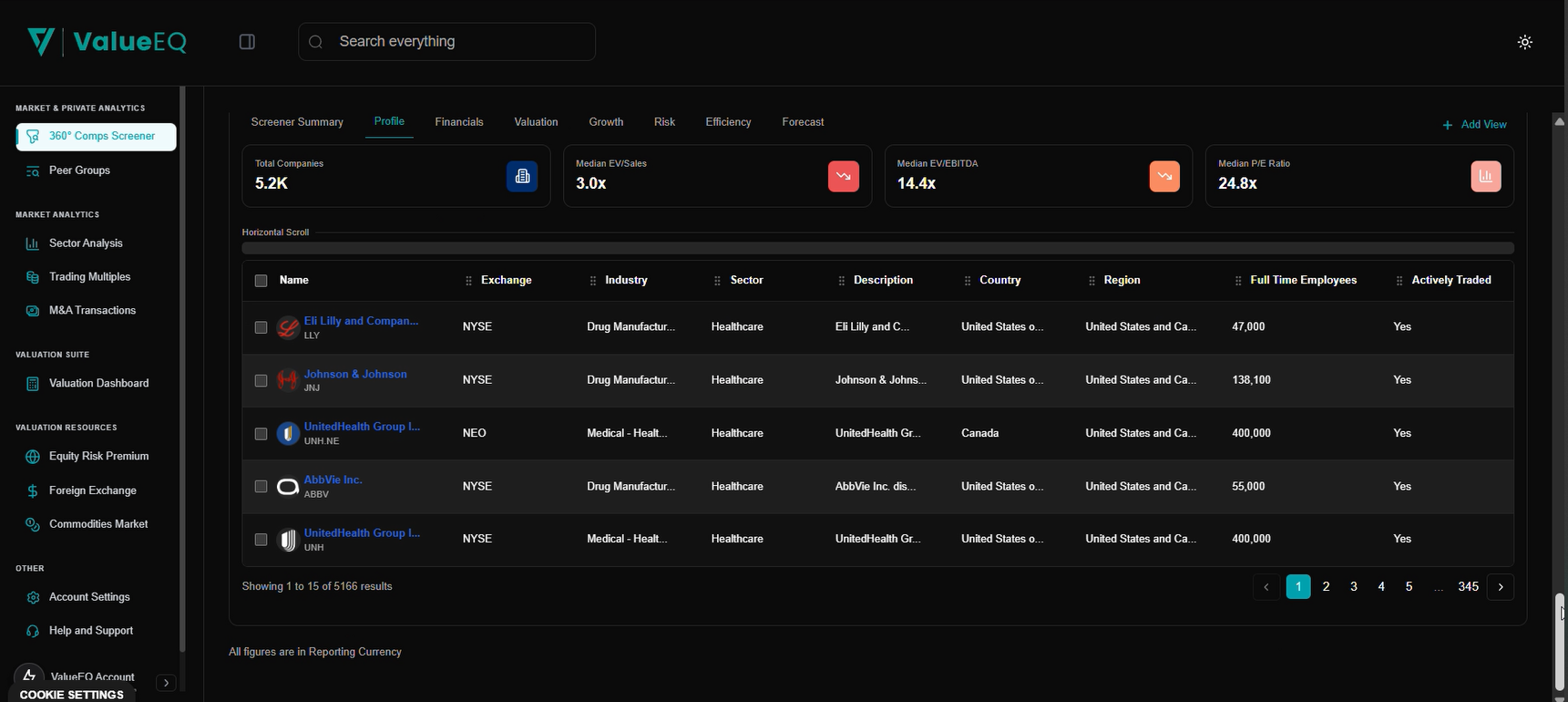

1. Trading Comps & Screening

• Access 60,000+ global listed companies.

• Search via filters or plain English AI queries.

• Save peer groups at different valuation dates.

• Export instantly to Excel.

Impact: Analysts save 65% of time compared to manual comp gathering.

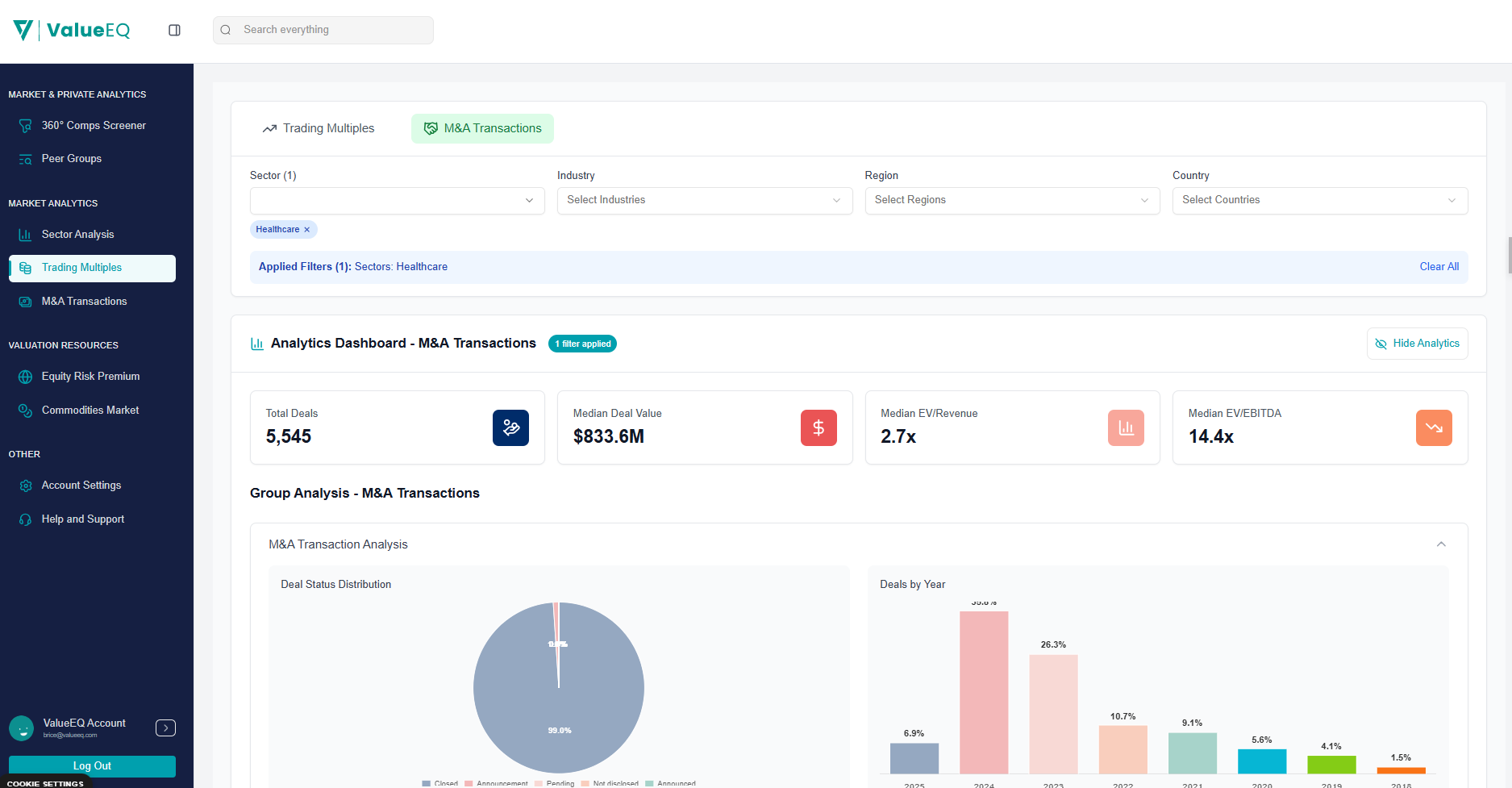

2. M&A Intelligence

• 60,000+ deals parsed and updated daily.

• Multiples automatically cleaned and IVS-compliant.

• Two-hour latency from filing to platform availability.

• Downloadable deal tearsheets for presentations.

Impact: Stay ahead of competitors with fresher, cleaner deal data.

3. Valuation Suite

• WACC Navigator: Automated capital cost estimates.

• DCF Models: From inputs to enterprise/equity value in minutes.

• Multiples Override: Adjust comps with custom assumptions.

• DLOM Models: Restricted stock studies and Finnerty models included.

Impact: Complete end-to-end valuations without leaving the platform.

4. Financial & Market Analysis

• 90+ KPIs across all industries.

• Peer benchmarking heatmaps.

• Real-time macro dashboards with FX and indices.

• AI commentary for context.

Impact: Replace scattered Excel sheets and manual updates with live dashboards.

Who Uses ValueEQ?

• Private Equity Firms: Sourcing and valuing acquisition targets faster.

• M&A Advisors & Valuation Consultants: Producing defensible, IVS-compliant valuations for clients.

• Investment Banks: Supporting fairness opinions and deal pricing.

• Corporate Finance Teams: Benchmarking competitors and building strategic plans.

• Venture Capital & Startups: Assessing valuation benchmarks during fundraising.

Pricing & Accessibility

• Solo Plan: €99/month · €780/year

• Team Plan (up to 5 users): €240/month · €2,400/year

• Enterprise Plan: Custom pricing for 6+ users, with SSO, SLA, and API access.

• All plans come with a 7-day free trial

• Beta Price-Lock Offer: Early users who sign up before December 31, 2025, lock in these rates for life.

Social Proof & ROI

• Efficiency: Analysts save 4+ hours per valuation project.

• Cost Savings: Firms save €20,000+ annually vs. legacy platforms.

• User Testimonial: “ValueEQ cut our comp-gathering time by 65%. The built-in WACC saved our pitch deck at 2 a.m.” — Senior Analyst, Boutique PE Firm.

• Capital IQ: Expensive, slow, outdated interface. → ValueEQ offers faster updates and modern usability at 90% lower cost.

• PitchBook: Strong VC coverage but weaker on valuation standards. → ValueEQ offers IVS-compliant ratios.