Agent Mobile App: Pigmy Agents can collect cash from Customers using a Mobile App/device which is installed on agent’s Mobile/Tablet.

Customer Mapping: Only the Customer A/c’s assigned to an Agent are loaded in that Agent’s App.

Data Capture Simplified: Agent collects amount from Customer, selects Customer A/c No. in app.

Real-time Transaction: Deposit transaction is processed immediately. Amount is credited into Customer A/c in Bank CBS in real-time.

Electronic Receipt: Customer receives a ‘transaction success’ alert via SMS/print slip immediately.

Simple and convenient transaction data capture and processing.

Portable devices ideal for Doorstep Banking and Financial Inclusion.

Rules out manual errors.

Online transactions processed in real-time.

Customer receives electronic receipt via SMS/print immediately.

No delay in crediting pigmy amount in Customer A/C*

Minimum risk of fraud.

Easy for Bank/Society to launch and rollout the system.

All features are subject to network & plan availability.

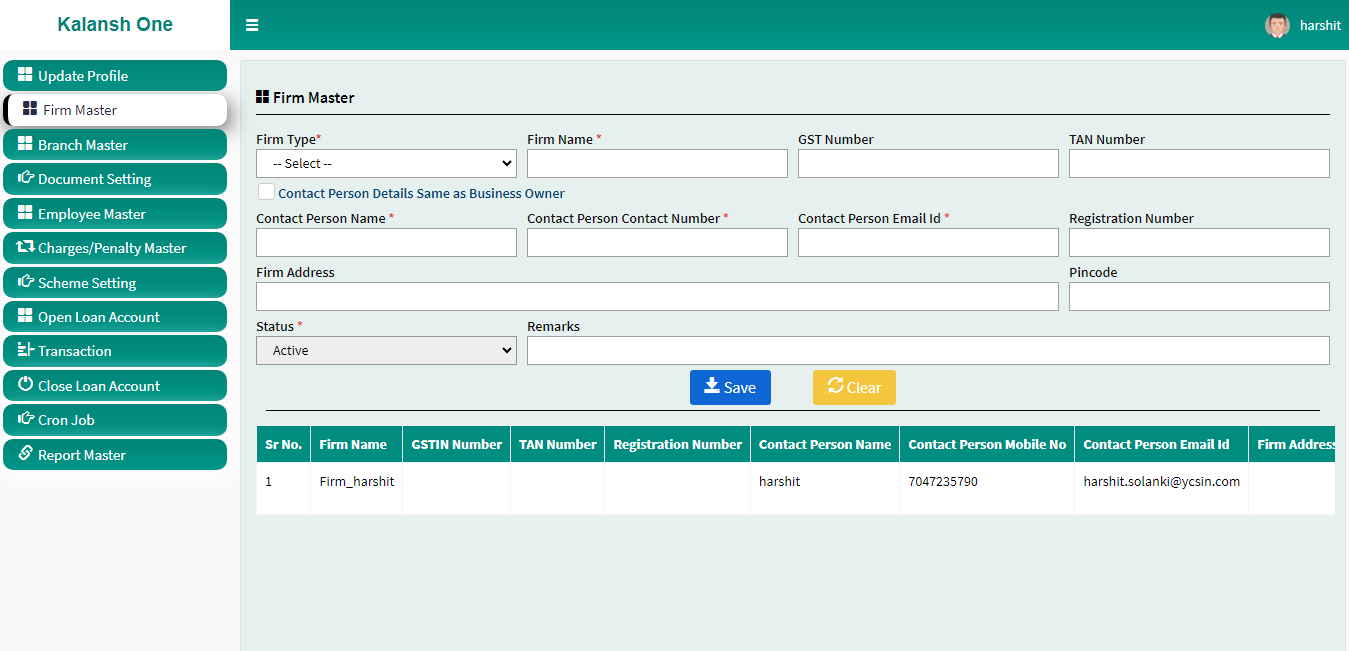

The Key Features of Kalansh One Software are as follows:-

Loan Eligibility auto calculation.

Loan approval Tracking system.

User friendly application.

For multiple branches.

Real verification on location.

Efficiency of the cloud.

Real time FI(Search Report) via mobile app.

Daily Installment Receiving.

Guarantor verification.

Centralized Solution.

Authenticated Access.

Technology and Customer Service Support.

Third-Party Integration.

Web and Mobile Compatibility.

100% Secure System.

Computerized Master LA New report /Hypothecation Report.

No need to pay Huge Development cost.

Scalability Cost.

All features are subject to network & plan availability.