Before anything else, let’s start with a big-picture view of what prospective employees really care about when they’re eyeing a new job. Before joining a company, many individuals—especially those who are mid-career professionals or even savvy entry-level workers—look beyond just a paycheck.

Sure, salary remains a key, but what they truly appreciate is a holistic support system that acknowledges their personal and professional lives.

People want to know: “Will I be valued here as a full human being, not just a worker?”

They look for signals of this in the company’s culture, opportunities for career growth, the balance between work and personal time, and, crucially, the set of rewards and perks their potential employer provides.

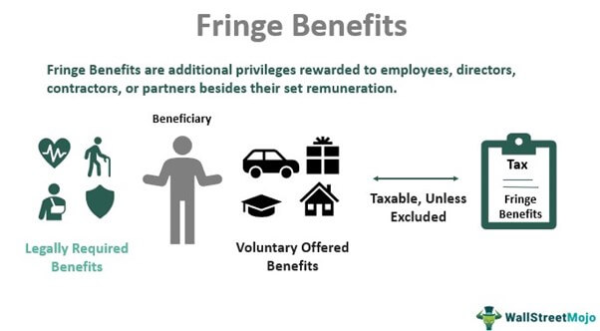

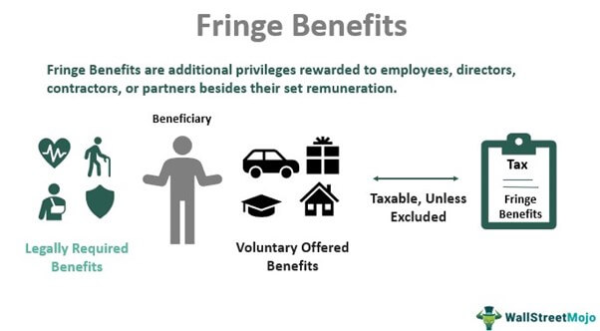

Now, this is where “fringe benefits” enter the scene in a significant way.

By definition, fringe benefit is a supplement to compensation, often manifesting as forms of support that contribute to an employee’s overall well-being. Examples of fringe benefits might include employer-sponsored health insurance, retirement savings plans, gym memberships, tuition reimbursement, commuter assistance,

child care assistance, and more.

Let's explore the concept of fringe benefits in detail and how it contributes to building a solid team.

» What Are Fringe Benefits?

“Fringe benefits” are the different extra perks, services, and resources that employers provide to employees on top of their regular salary or hourly wages. Instead of just paying you for the time you put in, employers offer these added benefits to recognize and support the broader aspects of your life—both at work and beyond.

Width: 600px, Height: 331px

Width: 0px, Height: 0px

Width: 602px, Height: 332px

Width: 604px, Height: 333px

Width: 605px, Height: 334px

Width: 605px, Height: 334px

Width: 607px, Height: 335px

Width: 609px, Height: 336px

Width: 607px, Height: 335px

Width: 605px, Height: 334px

Width: 601px, Height: 331px

Width: 600px, Height: 331px

Width: 599px, Height: 330px

Width: 597px, Height: 329px

Width: 595px, Height: 328px

Width: 596px, Height: 329px

Width: 597px, Height: 329px

Width: 597px, Height: 329px

Width: 599px, Height: 330px

Width: 600px, Height: 331px

Width: 600px, Height: 331px

Width: 602px, Height: 332px

Width: 602px, Height: 332px

Width: 602px, Height: 332px

Width: 602px, Height: 332px

Width: 602px, Height: 332px

Width: 602px, Height: 332px

Width: 0px, Height: 0px

Width: 602px, Height: 332px

Width: 602px, Height: 332px

Width: 0px, Height: 0px

The definition of fringe benefits is about wrapping more value around the job so that the overall compensation package emerges as more appealing and meaningful to current and prospective employees.

The key idea is that fringe benefits are designed to improve an employee’s well-being, improve job satisfaction, and potentially boost loyalty,

productivity, and retention. In doing so, they often serve as a differentiating factor for organizations competing for top-tier talent.

» Examples of Fringe Benefits & How They Work

Now that you know what fringe benefits are let us look at some of the key examples that show how these perks operate within an organization and why employees value them:

› Health Insurance & Wellness Programs

Employers partner with insurance providers to offer medical, dental, and vision coverage to employees, often at subsidized rates.

Below are the benefits that an organization can yield upon implementing health insurance and wellness programs as part of fringe benefits.

Width: 600px, Height: 400px

Width: 600px, Height: 400px

Width: 600px, Height: 400px

Width: 600px, Height: 400px

Width: 600px, Height: 400px

Width: 600px, Height: 400px

Width: 600px, Height: 400px

Width: 600px, Height: 400px

Width: 600px, Height: 400px

Width: 600px, Height: 400px

Width: 0px, Height: 0px

Wellness programs may include gym memberships, fitness class reimbursements, or access to mental health resources.

Why employees value it: Reduced healthcare costs and proactive health support translate into peace of mind and a greater sense of security for the employee and their family.

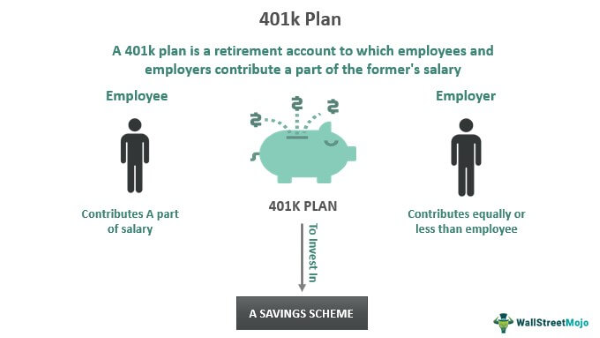

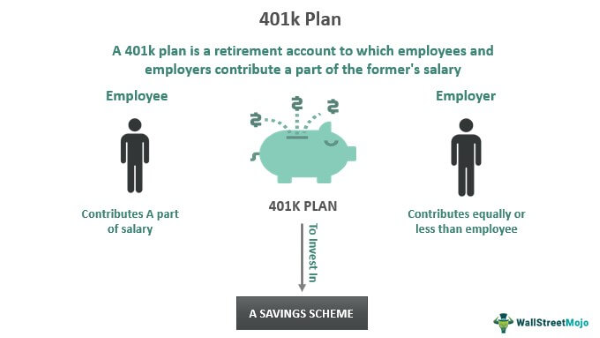

› Retirement Savings Plans (e.g., 401(k) or Pension Plans)

Employers contribute to an employee’s retirement account, sometimes matching the employee’s contributions up to a certain percentage.

Width: 600px, Height: 338px

Width: 600px, Height: 338px

Width: 600px, Height: 338px

Width: 600px, Height: 338px

Width: 600px, Height: 338px

Width: 600px, Height: 338px

Width: 600px, Height: 338px

Width: 600px, Height: 338px

Width: 600px, Height: 338px

Width: 600px, Height: 338px

Width: 0px, Height: 0px

Why employees value it: Knowing that the company is helping build their long-term financial stability encourages employees to stay longer and feel more invested in their future with the organization.

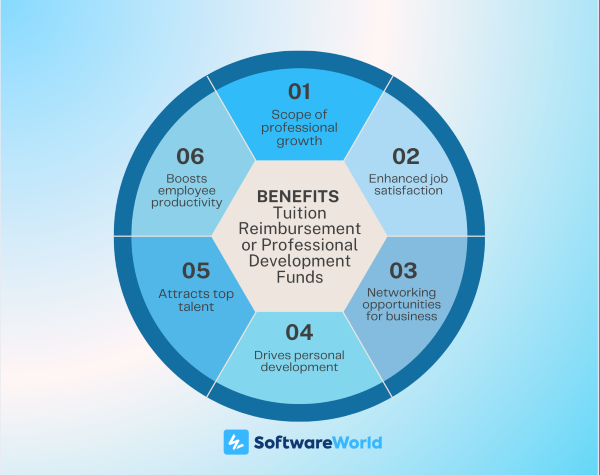

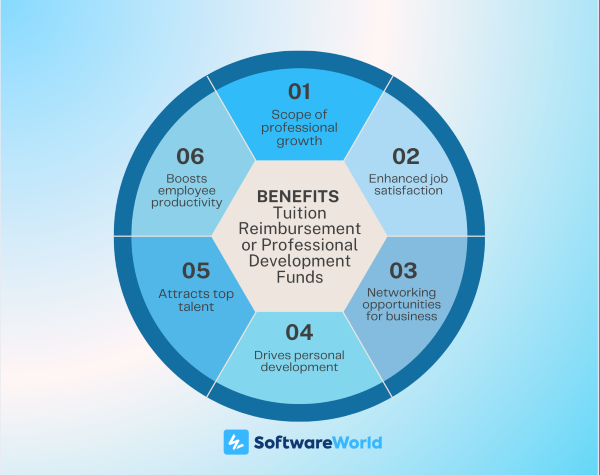

› Tuition Reimbursement or Professional Development Funds

Employers cover part or all of the costs of further education,

employee training, certifications, or workshops that help employees advance their skills.

Width: 600px, Height: 475px

Width: 600px, Height: 475px

Width: 600px, Height: 475px

Width: 600px, Height: 475px

Width: 600px, Height: 475px

Width: 600px, Height: 475px

Width: 600px, Height: 475px

Width: 600px, Height: 475px

Width: 600px, Height: 475px

Width: 600px, Height: 475px

Width: 0px, Height: 0px

Why employees value it: Investing in their career growth and learning opportunities signals that the employer cares about their professional trajectory, not just today’s job demands.

› Commuter Benefits & Transportation Subsidies

Employers may cover public transportation costs, offer discounted parking, or provide allowances for ride-sharing services.

Width: 0px, Height: 0px

Width: 0px, Height: 0px

Width: 600px, Height: 523px

Width: 600px, Height: 523px

Width: 600px, Height: 523px

Width: 600px, Height: 523px

Width: 600px, Height: 523px

Width: 600px, Height: 523px

Width: 0px, Height: 0px

Width: 0px, Height: 0px

Width: 0px, Height: 0px

Below are some of the commuter benefits you can extend to employees under fringe benefits.

Why employees value it: Minimizing the stress and expense of getting to and from work improves daily quality of life and can save employees significant time and money.

› Child Care Assistance & Flexible Work Arrangements

Employers may offer on-site childcare facilities, discounts at childcare centers, or flexible schedules, which can help parents better manage their work-life balance.

Why employees value it: Support for family needs fosters loyalty, reduces absenteeism, and helps employees stay focused and productive when they’re on the job.

» Key Considerations for Implementing Fringe Benefits Across Organizations

When implementing fringe benefits, organizations need to understand which perks are taxable, who qualifies for them, and how to comply with legal requirements. They must also establish clear guidelines for eligibility, stay updated on regulations, and effectively communicate benefits to employees.

It's also necessary to review and adjust these offerings regularly so that the fringe benefits align with business goals and workforce needs.

› Understanding Tax Implications of Fringe Benefits

When rolling out fringe benefits, it’s important to determine which perks are taxable and which may be exempt. Requirements vary by jurisdiction, so staying informed is critical.

Determining Taxable vs. Non-Taxable Benefits

- Common taxable benefits include cash-equivalent perks, such as gift cards or specific bonuses.

- Non-taxable categories often include qualifying health plans, specific educational assistance programs, or transit subsidies up to a specified limit.

Staying Current with Regulations

- Regularly review guidelines from tax authorities to ensure compliance.

- Consult with tax and legal professionals to understand reporting obligations.

Consistency in Application

- Apply standard criteria when classifying benefits to maintain fairness and clarity.

- Communicate policies internally so HR and payroll teams uniformly follow established processes.

› Determining Eligibility for Fringe Benefits Across Different Worker Classifications

Eligibility for fringe benefits may vary based on the employee’s relationship with the company. Standards should be carefully defined and documented.

Full-Time Employees

They typically have the broadest access to fringe benefits, which often include health coverage, retirement plans, and paid leave.

Part-Time and Seasonal Employees

- May receive scaled-down benefits.

- Consider setting minimum work hours or tenure requirements before granting certain perks.

Contractors, Freelancers, and Consultants:

- Generally not covered by standard employee benefits.

- If offering any perks, document the terms clearly to avoid misclassification issues.

Temporary Workers and Interns

- Eligibility depends on company policies and the length of the engagement.

- Some may receive select perks like subsidized meals or training opportunities rather than full benefits packages.

Volunteers or Unpaid Affiliates

- Usually, this section of workers is not granted standard benefits.

- If offering non-cash perks, ensure that doing so does not inadvertently shift their legal status to that of employees.

› Additional Considerations for Implementing Fringe Benefits

Cost Analysis and Budgeting

Aligning with Financial Goals

- Evaluate the total cost of each benefit relative to the organization’s compensation strategy.

- Consider administrative expenses, premium contributions, and long-term financial commitments before finalizing the package.

Evaluating Utilization and ROI

- Review which benefits employees actually use.

- Continuously assess the return on investment, adjusting offerings to support both workforce needs and organizational objectives.

Regulatory Compliance Beyond Taxation

- Labor Law Considerations: Ensure that extending benefits does not inadvertently conflict with wage and hour laws, leave policies, or mandatory benefits provisions in certain regions.

- Industry-Specific Regulations: Some sectors may have additional requirements. For example, education or government organizations might face extra scrutiny or need to follow unique guidelines.

Documentation and Record-Keeping:

Maintaining Accurate Records:

- Keep thorough documentation of eligibility criteria, enrollment records, and changes in benefit status.

- Accurate records support internal audits, reduce disputes, and streamline compliance reporting.

Communication and Employee Education

Clarity in Policies and Procedures:

- Provide clear information about what each benefit covers and how to access it.

- Offer FAQs, handbooks, or online resources that outline eligibility, enrollment periods, and any tax considerations.

Transparency About Changes:

- Communicate any modifications to benefits promptly to make sure everything is clear.

- Clearly explain reasons for changes—such as shifts in regulatory requirements or cost structures—so employees understand the context.

Cultural and Organizational Fit:

Aligning With Company Values and Workforce Needs:

- Select benefits that resonate with the organization’s culture and the demographics of its workforce.

- Periodically survey employees to gauge which perks they find most valuable and consider adjusting offerings based on feedback.

» What is Administration Software?

There is no need to shuffle through piles of paperwork or navigate clunky email chains because the HR team can have administration software. What it does is that it provides a single online place to see, select, and manage all the perks.

HR teams can easily access all such information through the

Benefits Administration Software, including healthcare plans, retirement savings options, and commuter benefits.

For employees, it’s the difference between feeling lost in a maze of benefits brochures and having a clear, easy-to-use dashboard that shows everything at a glance.

The core idea here isn’t just about technology; it’s about making the whole benefits process smoother, simpler, and more transparent.

These are some of the tools that are prevalent in the market:

- BambooHR — to easily manage and communicate various fringe benefits like health plans and wellness perks.

- Zenefits — helps HR teams monitor usage patterns, which aids in optimizing and adjusting fringe benefits according to employee needs and preferences.

- Workday — allows HR professionals to configure a wide range of fringe benefits examples for employees, from traditional health insurance to emerging perks like student loan assistance and wellness stipends.

- Namely — enable tailoring fringe benefits offerings and keep employees informed through an intuitive, user-friendly interface.

- Gusto — simplifies the process of offering fringe benefits, making it straightforward for employees to select plans that align with their needs.

» Benefits of Administration Software

The use of administration software brings with it a range of advantages for both employers and employees.

Let’s check out in detail as we unfold how one can make the most out of it.

All benefits data—including health coverage details, commuter subsidies, and other fringe benefits—are compiled into one secure digital repository. It's one way to reduce the need to sort through paper files or multiple spreadsheets. HR teams and employees can access the information they need with a few clicks.

› User-Friendly Enrollment & Selection Processes

During enrollment periods, employees can navigate, compare, and select their desired fringe benefits through an intuitive online portal. In a way, employees have a self-service system with straightforward descriptions and comparison tools, simplifying their decision-making process.

› Automated Compliance & Regulatory Updates

The platform is designed to stay aligned with current legal requirements, tax regulations, and reporting standards related to fringe benefits. Compliance factors are tracked manually at a low level so that companies avoid penalties and maintain accurate, timely reporting.

› Streamlined Communication & Notifications

The software sends reminders and updates about enrollment deadlines and benefit changes directly to employees’ inboxes or dashboards. These prompt notifications ensure employees have the information they need, increasing the likelihood that they will use their available benefits effectively.

› Improved Employee Experience & Satisfaction

With transparent, user-friendly access to their fringe benefits, employees gain a clearer understanding of the compensation package offered. When employees can readily understand and use these benefits, they are more likely to recognize their employer’s commitment to their well-being, which can, in turn, improve morale, reduce turnover, and support higher engagement levels.

» Concluding Thoughts

Managing fringe benefits effectively requires organizations to rely on administration software. These platforms centralize information, streamline enrollment processes, handle compliance tasks, and drive transparency. Ultimately, both HR teams and employees can navigate complex benefit portfolios with greater ease and efficiency.

But, when implementing fringe benefits, it’s essential to consider factors such as taxation, eligibility criteria for different classifications of workers, and the ever-shifting regulatory landscape.

Cost analysis, documentation, open communication, and alignment with company culture further ensure that the benefits offered remain relevant, legally sound, and genuinely valued by employees.